Horizontal integration is a business strategy that involves merging or acquiring companies in the same industry or value chain. This method is often used to achieve economies of scale, increase market share, and gain a competitive advantage. In simple terms, it is the process of expanding a business by adding similar products or services to its existing portfolio. Horizontal integration can be a powerful tool for business growth, but it also comes with its own set of challenges and considerations. In this article, we will explore horizontal integration in depth and how it can be utilized as a method of scaling a business. We will also discuss its role in acquisitions and mergers, and how it can benefit businesses looking to expand in the market. So, let’s dive into the world of horizontal integration and its potential for business expansion.

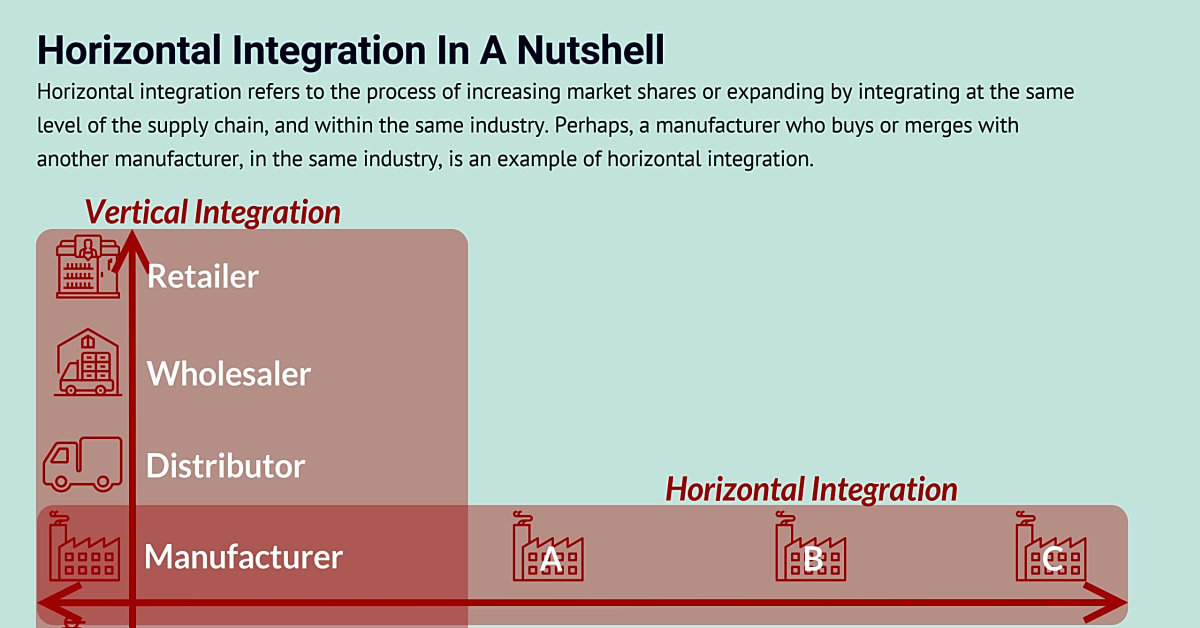

To fully understand the concept of horizontal integration, it is important to first distinguish it from vertical integration. While vertical integration involves acquiring businesses along the supply chain, horizontal integration focuses on expanding within the same level of production or distribution. For example, a shoe company acquiring another shoe company would be considered horizontal integration, while acquiring a leather supplier would be vertical integration.

Horizontal integration can take various forms, such as mergers, acquisitions, joint ventures, or partnerships. These strategies can provide businesses with several benefits, including increased economies of scale, reduced competition, and enhanced market power. For instance, by joining forces with a competitor, a company can eliminate price wars and improve its bargaining power with suppliers and customers.

However, horizontal integration also presents some challenges that businesses must be aware of. Mergers and acquisitions can be complex and costly processes, and integrating two different organizational cultures can be difficult. Moreover, there is always the risk of failure if the integration is not executed properly.

Despite these potential challenges, horizontal integration remains a popular and effective method for scaling a business. Many successful companies have used this strategy to grow and dominate their respective industries. For example, Disney’s acquisition of Marvel Entertainment expanded its media empire, and Facebook’s purchase of Instagram allowed it to enter the photo-sharing market.

Challenges of Horizontal Integration

While horizontal integration can offer many benefits, it also comes with its own set of challenges that businesses must carefully consider before pursuing this strategy. Some potential drawbacks to keep in mind include:

- Increased competition: By merging or acquiring other businesses in the same industry, companies may find themselves competing with their own former competitors. This can lead to intensified competition and potentially impact profits.

- Cultural integration: Combining different company cultures and work styles can be a difficult and time-consuming process. It is important to carefully manage this integration to ensure a smooth transition for employees.

- Regulatory hurdles: Horizontal integration can also face regulatory challenges, as it may raise concerns about monopolistic practices and antitrust laws. Companies must navigate these regulations carefully to avoid any legal issues.

Despite these challenges, horizontal integration can still be a valuable strategy for business expansion if approached thoughtfully and strategically. By understanding and addressing these potential drawbacks, companies can maximize the benefits of horizontal integration and drive growth and success in a competitive market.

Real-Life Examples

In order to fully understand the impact of horizontal integration, let’s take a look at some real-life examples of companies that have successfully implemented this strategy.

Disney and Pixar

In 2006, Disney acquired Pixar, a leading animation company, in a horizontal integration move. This allowed Disney to expand its reach in the animation industry and gain access to Pixar’s advanced technology and talented team. The merger proved to be a success, with blockbuster hits like Finding Nemo and The Incredibles being released under the Disney-Pixar partnership.

Facebook and Instagram

In 2012, Facebook acquired Instagram, a popular photo-sharing app, in a horizontal integration move. This not only allowed Facebook to expand its social media presence, but also gave it access to Instagram’s large user base and innovative features. The acquisition has paid off for Facebook, with Instagram becoming one of the top social media platforms in the world.

Nestle and Kraft Foods

In 2015, Nestle acquired Kraft Foods’ frozen pizza business in a horizontal integration move. This allowed Nestle to strengthen its position in the frozen food market and gain access to Kraft’s well-known brands like DiGiorno and Tombstone. The acquisition has helped Nestle increase its market share and expand its product portfolio.

Advantages of Horizontal Integration

In today’s competitive market, businesses must constantly strive to grow and expand in order to stay ahead. One effective way to achieve this is through horizontal integration, a strategic approach that involves merging or acquiring other businesses in the same industry. This allows companies to increase their market share, gain access to new technologies and resources, and ultimately drive growth and success.

There are several key benefits that businesses can experience through horizontal integration:

- Increased Market Share: One of the main advantages of horizontal integration is the ability for a company to increase its market share. By merging or acquiring other businesses in the same industry, a company can expand its customer base and reach a larger audience.

- Access to New Technologies and Resources: Horizontal integration allows companies to gain access to new technologies and resources that may not have been available to them before. This can give them a competitive edge and help them stay ahead in their industry.

- Synergy and Cost Savings: When two companies merge or integrate, they can often achieve cost savings by combining their resources and eliminating duplicate processes. Additionally, the synergy between the two companies can lead to increased efficiency and productivity.

- Diversification: By merging with or acquiring other businesses in the same industry, a company can diversify its product or service offerings. This can help reduce risk and make the company less susceptible to market fluctuations.

Overall, horizontal integration can provide numerous benefits for businesses looking to expand and grow. It allows companies to increase their market share, gain access to new technologies and resources, achieve cost savings, and diversify their offerings. By strategically implementing horizontal integration, companies can position themselves for long-term success in today’s competitive market.

In conclusion, horizontal integration is a powerful tool that businesses can use to achieve growth and expansion. By acquiring or merging with other companies in the same industry, businesses can gain numerous advantages and improve their chances of success. However, it is important to carefully evaluate the potential challenges and risks associated with this strategy before making any decisions. With proper planning and execution, horizontal integration can be a game-changing move for any business looking to scale and thrive in a competitive market.